Business

16 Reasons Femi Otedola’s ‘Making It Big’ Is A Must-Read Life-Changer-Kunle Bakare Reveals

…has settled comfortably on the bestseller list

Femi Otedola’s ‘Making It Big: Lessons from a Life in Business’ debuted online and in bookstores on Monday, August 18 across the world to rave reviews. And in one week of release, it has settled comfortably on the bestseller list.

Applauded by moguls, economists and technocrats, the 286-page business memoir of the Chairman of First HoldCo PLC and Geregu Power PLC topped charts and discourses in just seven days of global release.

Appearing at number 4 on Amazon UK best seller list in business biographies and memoirs on Tuesday, August 19, it rose to number 3 on Wednesday, August 20—and it has settled there for many days.

Part-autobiographical and self-help, ‘Making It Big’ is laced with lessons for budding entrepreneurs and aspiring business leaders. It tells Otedola’s story vividly and refreshingly—from birth, family, schools, businesses and more—as well as lists pieces of tips and advice to show us how to advance in life and in business.

Otedola narrated the story of his life and business with honesty and candour—no-holds-barred, with details many will refuse to share in order to save face, or to portray a no blemish persona.

Inspirational and riveting, ‘Making It Big’ has been described as ‘one of the most important books you will ever read’ for these reasons and more:

.Tells an inspiring grass-to-grace-to-grass-and-grace story

Otedola’s remarkable journey to billionaire status sounds like a fairy-tale which warms hearts and bosoms immeasurably.

Though born into a middle class family on November 4, 1962, the author struggled through school, and managed to go beyond only O’level as he refused to continue his A’level.

He became his father’s driver and personal assistant, joined the old man’s printing press, and moved on to the corridors of power when Sir Michael Agbolade Otedola was governor of Lagos.

After power, he became a money lender whose occupation was described as ‘sleeping for a living’ by his daughter.

He started Zenon Petroleum and Gas on March 10, 1999, made billions and lost all of it.

He bounced back with Forte Oil, and reclaimed his wealth and glory.

.Provides actionable business advice and tips

Practical strategies for entrepreneurs and business leaders are well articulated and graphically presented.

Divided into 5 sections—In the beginning, Growth and expansion, Reaching the top, Collapse and rebirth, and Rediscovery—‘Making It Big’ has 23 lessons with hundreds of actionable tips to navigate business and life.

From ‘start small, keep dreaming’ to ‘know your market’, ‘don’t fool around with your health’, ‘recognise your limits’ and ‘appreciate the God factor’, Otedola recounted compelling accounts and offered easy-to-follow-and-execute tips.

Coaches proven leadership techniques and effective team management methods

Effective methods for building and managing successful teams are put to rewarding ends by the mogul.

From hands on do-most-of-the-work yourself when starting out as a micro business, to having reliable and dutiful staff as you grow the business, and sit-back and allow younger talents to flower and flourish, different models are on display in ‘Making It Big’.

Otedola had only two workers in the money lending business, worked with only a driver at the beginning of Zenon, and grew bigger with marketing executives driving cars emblazoned with Zenon on the streets of Lagos.

At the beginning of Forte Oil, he was no longer the MD. He ceded the role to a younger man—and became an entrepreneur in the real sense of the word.

Teaches resilience in adversity

Otedola’s ability to overcome obstacles and challenges made him the man he has become.

On many occasions, the author was down on his luck. He was embarrassed and humiliated, derided and laughed at. But he never dwelt on the reversal of fortune for too long.

For a man who lost $1.218 billion in 2009, hounded by bank chiefs who were too glad to hawk his assets, he’s resilience in flesh and blood.

With the God factor and grace, he inched his way back to profitability after rebranding—and returned with glory to the celebrated Forbes’ rich list.

Illuminates insight into Africa’s business workings

Context-specific expertise for entrepreneurs and policymakers is necessary to successfully get ahead in Nigeria and beyond.

There’s hardly any wealthy African with sustained riches who is not close to the corridors of power. Apart from knowing how government in this part of the world works, keeping your ears to the ground to be abreast of policies that will affect your interest, you have to court those who make important decisions.

And ‘Making It Big’ is packed with details of how this political commonsense helped in humongous measure.

From getting allocation of diesel from Nigeria National Petroleum Corporation (NNPC), to buying African Petroleum, and diesel deregulation, being close to power keeps doors of opportunities ajar.

Spotlights mastery of personal growth principles

Otedola’s philosophy on self-improvement and development gave him an edge.

From primary school, Otedola saw himself as a successful businessman—and the affirmation was put into practice by asking his dad for a briefcase as school bag. When his classmates laughed at him, he didn’t allow it to stop him.

This attitude, of planning and executing his dreams, litter his life.

From trimming nails for a fee as a young lad, learning the rudiments of printing, lending money for appreciable interest, selling diesel in drums in a pick up van, buying tank farms and vessels and diversifying into property, investing in the stock market, power generation and more, ‘Making It Big’ is a testament to a life of purpose.

Showcases the depth of economic empowerment

The impact of entrepreneurship on economic growth and development runs deep and far.

Apart from providing thousands their livelihoods, Otedola’s businesses have turned many lives around for good, built fortunes for some and created immense economic benefits for the state.

The ideas of an entrepreneur, especially those assisted by grace and catapulted by the God factor, create enormous multiplier effects with ample direct and indirect beneficiaries which echo farther than the eyes can see.

From keeping immediate families afloat to making dreams come true, the resources generated by businesses also facilitate the infrastructure provided by the government.

Displays authentic leadership style

Otedola’s genuine and relatable approach to business and life warms hearts and brightens faces.

Though resolute, strong-willed and tough, the author’s simplicity is disarming as it easily makes him approachable and adored.

Let’s just take a look at one example: the start of Zenon Petroleum. The business of diesel supply started with a van loaded with drums of the product, a driver and Otedola in denim trousers and cotton polo shirts. And the two of them—driver and author—moved from offices to houses to deliver the product from sunrise to sunset. Day after day.

Check this scenario: his chief operating officer advised him to resign as MD from the company he founded. And he did! For the benefit of the business.

These uncommon attributes and soft skills transformed his life from ordinary to fabulously extraordinary.

Lists timelesss business lessons and how they work

‘Making It Big’ contains valuable insights applicable across industries and contexts.

Let’s examine just a few: ‘self-belief is non-negotiable’, ‘create a warm working environment’, ‘make your life simple’, ‘leave family out of your business’, ‘forgive those who hurt you’, and ‘indiscipline will ruin your business’.

These lessons are so timeless and tested that it’s impossible to succeed big without living them to the letter!

Highlights guidelines that sharpen motivation and passion

Inspiration to strive for excellence and pursue your passions abound in ‘Making It Big’.

It is important to always know the why (like Simon Sinek preached in his book, ‘Start with Why’). Whatever you plan to do, in business and in life, you get huge returns when you know the reasons for the adventure.

A rickety tanker was dispensing diesel in the author’s house (weeks later than promised), spilling dirty oil all over the compound. And the idea struck: I can clean up this business, provide better service faster and hassle-free.

That’s how Zenon Petroleum started small, with the author continually dreaming of changing the landscape of the diesel business.

And he did: controlling over 90 percent of the business.

Itemises innovative business strategies

Otedola’s creative approach to business and problem-solving is enviable.

The author’s creative approach and problem-solving skills came to play on many occasions, and we couldn’t stop applauding the outcomes.

When Geregu Power was about to start, extensive research and consultation went on behind the scene. And partnering with China’s biggest energy company was a game changer.

Instead of a DisCo, a distribution company (which would have incurred irreparable losses), they settled for a generating company (GenCo). That move saved Geregu Power headaches, and planted it on the path of profitability.

Also, when he had extracted the maximum benefits from Forte Oil, he sold it in 2019—to the amazement and bewilderment of all. Many are still confounded about the sale.

But Otedola moved on—to bigger net worth and more money to deploy to other lucrative concerns. And getting a foot-hold in First Bank, emerging its largest shareholder and now chairman of First HoldCo PLC taught us a hundred and one things about his gift to see far so clearly!

Guides us on how to build strong friendship and networks

The significance of building strong and enduring relationships and networks is apparent in the success story of Olufemi Peter Otedola.

From childhood, he has cultivated warmth and empathy, friendliness and charity.

And Otedola has put to good use his charm and easy ways to land lasting and hugely rewarding relationships.

He wormed his way into the hearts of notable figures like Chief Wahab Folawiyo (whom he joined in counting cash at his palatial home alongside his children), Prince Samuel Adedoyin (who has known him since he was a far younger man, later patronising Zenon and writing a blurb for ‘Making It Big’), Alhaji Aliko Dangote (whose Rolls Royce fascinated him as a young lad, and both evolved as close friends), Chief Olusegun Obasanjo (who provided access which led to diesel deregulation) and many more.

Explains how adaptability in business provides the anchor for survival

The acumen to quickly respond to and navigate changing environments and circumstances catapulted Otedola onto the big league.

At every turn, he knows what business to start and which to drop. His rise testifies

to this gift.

Are we talking about when he saw the need to provide quick loans to customers who couldn’t access the bigger banks? Or, when he stepped in to sell diesel to power homes and companies, industries, vehicles and trawlers?

Will it be when he moved to the power sector with a GenCo? Or when he left the petroleum and oil sector for good?

Demonstrates goal-setting, disciplined execution and high achievement tactics

‘Making It Big’ is full of practical directions on how to set goals, pursue your objectives strategically and diligently, and achieve them.

Every chapter begins with a particular topic, episode, scenario, or experience—and how the author set about achieving his goals. Even when he failed, he listed the reasons and what he learnt from the mishap.

Otedola plans for short, medium and long-term. He thinks through his ideas, nurtures and weeds them before he acts with precision and speed.

Just imagine how he bought African Petroleum. The deal had long been concluded and sealed—before he made a move. And he won.

Illustrates how to learn from failure

Failing forward (as John C. Maxwell described it in his book of the same title) is a mantra Otedola embodied. He’s not a stranger to failure. And even losing everything!

He has managed to overcome the shame and disgrace that come with setbacks—and he emerges stronger with a will of steel.

How many of us can lose $1.218 billion, buried in debt and humiliated, and come out richer and bigger?

Can you withstand the jibes of your friends who discredit your honest toil at random? ‘Where’s your truck?’ his friends laughed at him at nightclubs because he’s the son of a former governor. ‘Are you here to sell diesel?’ they constantly teased.

They treated him as a failure who didn’t leverage on his father’s political goodwill. But they were so wrong. Otedola knew then that he had to take good care of his family, was ready to roll up his sleeves in honour of the dignity of labour, and he eventually built the big business of his dream.

Advises us on philanthropy and giving back

Making a positive impact in society, reducing desperation and angst, and pulling people up with charity always sat well with Otedola.

From scholarship to indigent students to interventions to save people from certain death triggered by failing health, building a faculty in a university, funding projects in churches, mosques and more, much more, he’s a philanthropist with a large heart. Otedola is perpetually stepping forward to lend a helping hand.

His Sunday, November 10 2019, $14 million donation to Save the Children charity stunned all.

Otedola, the cheerful giver, exemplifies a deep Yoruba philosophy of acknowledging that one is wealthy primarily to uplift others: ni t’ori opo eniyan l’ase da e lola; ni t’ori talaka l’ase bukun e [you are splashed with wealth and humongous resources to uplift legions; you are blessed abundantly to change the lives of the less-privileged and the needy].

Femi Otedola took us through all his business adventures and misadventures to provide first-row guidance with ‘Making It Big: Lessons from a Life in Business’.

The ‘nail trimmer’ and ‘money lender’, the man who lost everything, humiliated and derided, has gained so much that he’s living his dream with houses in Lagos, London, Dubai and Monaco—and has at his beck and call all the posh and plush objects of desire dreamt only by men of means. And what’s more, he has turned his empire into a lifeline for his country and compatriots.

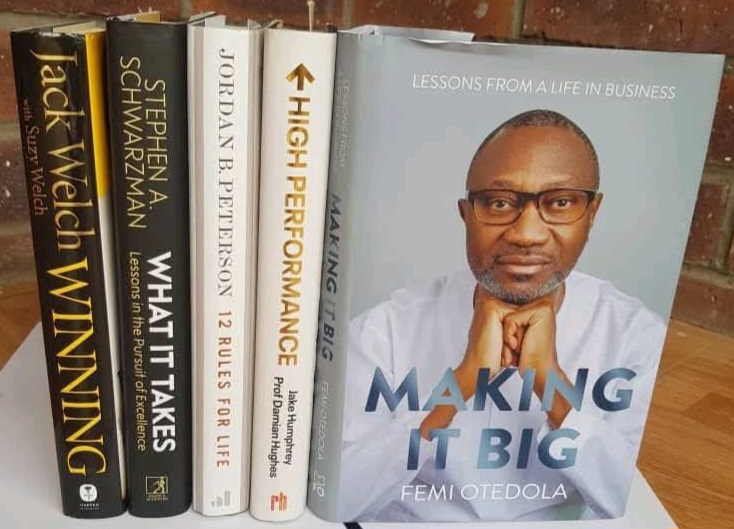

For these reasons and more, the business memoir of the 62 year-old Ibadan- born businessman from Odoragunsin (near Epe, Lagos State)—in the top league with Stephen A. Schwarzman’s ‘What It Takes: Lessons in the Pursuit of Excellence’, ‘Winning’ by Jack Welch with Suzy Welch, Jordan B. Peterson’s ’12 Rules for Life: an Antidote to Chaos’, and ‘High Performance: Lessons from the Best on Becoming Your Best’—is a must-read life-changer which is truly ‘one of the most important books you will ever read’.

Business

Black Market Naira To Dollar Exchange Rate Today 12th January 2026

What is the Dollar to Naira Exchange rate at the black market, also known as the parallel market (Aboki fx)?

You can swap your dollar for Naira at these rates.

How much is a dollar to naira today in the black market?

The exchange rate for a dollar to naira at Lagos Parallel Market (Black Market) players buy a dollar for N1490 and sell at N1505 on Sunday, 11th January 2026 according to sources at Bureau De Change (BDC).

Black Market Exchange Rate Today 12th January, 2026

Buying Rate N1485

Selling Rate N1500

The exchange rate between the US dollar (USD) and the Nigerian naira (NGN) which rate we have given above; is a topic of high constant interest for people who are Nigerian and businesses and policymakers in Nigeria.

This rate of dollars to naira exchange rate influences not only the cost of imported goods but also the cost of travel, international education, and even local prices of certain commodities.

Please note that the Central Bank of Nigeria (CBN) does not recognize the parallel market (black market), as it has directed individuals who want to engage in Forex to approach their respective banks.

Business

BREAKING: Petrol Depot Owners Crash Prices To Cheapest; Details Emerge

Petrol prices at Nigerian depots have dropped to their lowest levels in months as intense competition grips the downstream market, following the apparent collapse of the fuel supply agreement between the Dangote Petroleum Refinery and independent marketers.

Fresh findings show that depot owners have slashed ex-depot prices to as low as N710 per litre, a sharp reversal from the steep hikes recorded just weeks earlier.,

In the first week of January 2026, depot owners sharply increased gantry prices after reports emerged that the Dangote Refinery had shut down its petrol production unit for maintenance.

Although the refinery denied the reports, the speculation was enough to jolt the market.

Depot prices surged, and the increases quickly filtered through to filling stations nationwide.

Independent marketers raised gantry prices from around N720 per litre to over N800 per litre, with analysts noting that depot operators were exploiting uncertainty surrounding Africa’s largest refinery.

Depot owners reverse course as competition intensifies

The price spike, however, has proven short-lived.

Checks reveal that depot owners have now reversed course, cutting prices aggressively to stay competitive with Dangote Refinery’s pricing structure, especially as fresh fuel imports enter the Nigerian market.

Data from PetroleumPriceNG shows that several major depots reduced prices significantly in recent days.

As of Sunday, January 11, 2026, ShellPlux sold petrol at N710 per litre, MAO at N715, while A.Y.M.

Falling crude oil prices add more pressure

Energy experts say global oil market dynamics are also contributing to the decline in local petrol prices.

“Crude oil is currently trading between $50 and $60 per barrel in the international market,” energy policy analyst Adeola Yusuf told Legit.ng.

According to him, ongoing geopolitical tensions involving Venezuela and Iran have pushed crude prices lower, with direct implications for refined fuel costs.

“Crude oil is often used as a political tool and is highly sensitive to geopolitical developments. When prices drop, refined product prices usually follow, especially in domestic markets,” Yusuf explained.

Business

Good News: Cooking Gas Prices Drop As LPG Supply Improves Across Nigeria

Prices of liquefied petroleum gas (LPG), commonly known as cooking gas, are crashing in several parts of the country as retailers report improved supplies.

According to a market survey by PUNCH, retailers and consumers confirmed that prices have dropped and the product has become more available across the country.

This development follows months of scarcity, which led to a nationwide hike in prices. The scarcity peaked in September 2025.

Consumers in Lagos, Ogun, Oyo and other states confirmed that they purchased cooking gas within the N1,050 to N1,400 range. Some major marketers were also reported to be selling directly to consumers at around N900 per kilogramme.

For many households, the current prices represent a significant improvement from the sharp increases recorded last year, when LPG prices surged after a dispute involving the Dangote refinery and the Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN) led to the shutdown of some gas facilities.

Despite the improvement, several consumers said they were hopeful that prices would fall below N1,000 per kilogramme in the new year, arguing that lower costs are critical to promoting clean cooking and reducing reliance on firewood and kerosene.

Speaking on the situation, the National Chairman of the Liquefied Petroleum Gas Retailers branch of the Nigeria Union of Petroleum and Natural Gas Workers (NUPENG), Ayobami Olarinoye, said the LPG market had become relatively stable, with increased supply reaching Lagos.

According to Olarinoye, some off-takers are now receiving gas in Apapa, Lagos, helping to ease availability challenges experienced in previous months.

He explained that retail prices at street-level outlets currently range between N1,300 and N1,400 per kilogramme, noting that costs vary based on neighbourhoods, transportation and logistics.

Olarinoye added that prices could be lower at filling stations and gas plants, where operational and distribution costs are reduced.

He further disclosed that retailers currently purchase LPG from major marketers at prices between N960 and N1,050 per kilogram, depending on the supplier. According to the NUPENG official, sellers offering LPG below N1,000 per kilogramme are typically major dealers who own their own plants and sell directly to end users and do not distribute to retailers.

-

Business19 hours ago

Business19 hours agoBREAKING: Petrol Depot Owners Crash Prices To Cheapest; Details Emerge

-

News2 days ago

News2 days agoBuhari’s Ex-Minister Pantami Breaks Silence Over Alleged Wedding Plan With Aisha Buhari

-

News1 day ago

News1 day ago“Do Not Test Trump’s Resolve”: US Issues Fresh Threat To Nigeria

-

Sports2 days ago

Sports2 days agoAFCON: Nigerian Billionaire Splashes Dollars On Super Eagles

-

Lifestyle2 days ago

Lifestyle2 days agoChimamanda: Heartbreaking Details About What Killed Author’s Late Son Emerge

-

Entertainment24 hours ago

Entertainment24 hours agoSO SAD: Actress and Content Creator Sunshine D!es After Surgery; Details of Last Moment Trends

-

Politics7 hours ago

Politics7 hours agoFCT Minister Wike Reacts To Call For Tinubu To Sack Him

-

News18 hours ago

News18 hours agoBREAKING: KWAM 1 Writes Ogun Govt, Accuses Fusengbuwa Ruling House of Plot to Exclude Him From Awujale Selection