Business

‘I invested In A Ponzi Scheme’: Nigerians Fall Victim To Crypto Scams

Experts say financial illiteracy, lax regulations, greed and economic hardship make people susceptible to scam companies.

Lagos, Nigeria — Mandela Fadahunsi, who works at a technical training school in Ikeja in Nigeria’s Lagos, never believed he could fall victim to a Ponzi scheme.

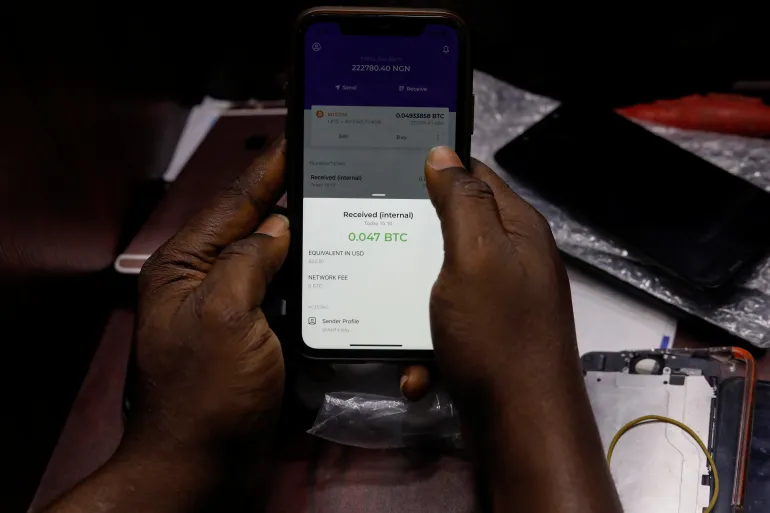

On April 6, the 26-year-old was starting his day when a WhatsApp notification lit up his phone screen. Someone on the group chat for investors of the cryptocurrency investment platform, Crypto Bridge Exchange (CBEX), had tried and failed to withdraw some funds, so they wanted to confirm if it was a general issue. Fadahunsi quickly logged on to his digital wallet and tried to withdraw 500 USDT, a cryptocurrency that stands for United States Dollar Tether, or simply Tether.

But 24 hours later, a process that should have taken just 10 minutes was yet to complete. He knew then that something had gone wrong. He started to panic, but half-hoped it was just a glitch or a minor system error.

“They [CBEX administrators] said it was as a result of the excessive volume of people trying to withdraw, and that all withdrawals have been placed on hold until 15th of April,” Fadahunsi told Al Jazeera.

On the 15th, he and fellow investors waited but heard nothing. On subsequent days, the administrators gave more excuses until the site stopped working altogether, and everyone’s money disappeared without a trace. That is when he realised he had been scammed and might never be able to recover the 4,596 USDT stablecoin in his wallet.

While Fadahunsi tallied his losses, the issue went viral on social media platforms.

Many more Nigerians shared their stories of loss, while others mocked them for losing their money to scammers. Some members of the public, filled with rage, attacked and ransacked CBEX offices in Ibadan and Lagos.

CBEX launched operations in Nigeria in July 2024, claiming to be able to generate immense trading profits using generative artificial intelligence. By January, it had gained serious popularity through referrals and smart advertising.

Fadahunsi and thousands of other people invested with the hope of making a maximum profit – the scheme promised up to 100 percent return on investment after a 40- to 45-day maturation period. At the start, the scheme did pay out, and the testimonies of successful initial investors attracted more people to sign up.

But after nine months of operation, the music stopped as the platform made away with an estimated 1.3 trillion naira ($840m), according to the official Nigerian Financial Intelligence Unit (NFIU). It left investors stunned.

Nigeria’s anticorruption agency, the Economic and Financial Crimes Commission (EFCC), has since labelled CBEX a Ponzi scheme. Experts say the organisers of such scams usually promise to invest people’s money in something that generates high returns, but in reality, it is investment fraud that pays existing investors with funds collected from new ones. Once a large number of people cash out, and new investors into the scheme dry up, it collapses.

Ponzi schemes, including CBEX, are usually not backed by any discernible economic activity, experts say. According to Ikemesit Effiong, from the Lagos-based socioeconomic advisory firm, SBM Intelligence, most times these businesses do not have anything to sell and have no recognisable business models. Even the agriculture-based ones claim to have products that investigators are unable to track. They also largely rely on existing investors to bring in new investors who serve as their downlink in the pyramid scheme.

Experts say that in Nigeria, widespread financial illiteracy, lax regulations, greed, economic hardship and peer pressure make investors susceptible to the machinations of Ponzi organisations that combine aggressive advertising, word-of-mouth campaigns charged by incentives, and initial high returns.

But at the end, the schemes leave victims – many of whom invest their savings, business capital, and borrowed money – unable to do anything but watch their hard-earned money disappear.

‘Make some gains’

Fadahunsi first heard about the CBEX scheme from colleagues at the start of the year. Initially, he was hesitant. But a few days later, his neighbour also mentioned the platform. Recognising that his close associates were participating, and not wanting to miss out, he decided to invest.

“I also thought the money was just sitting in my account, and it could be somewhere where I can make some gains on my money,” he explained.

In early February, he dipped into his rent savings and withdrew the entire 800,000 naira ($517). With that, he bought 500 USDT from the crypto exchange platform Buybit, receiving the coin in his digital CBEX wallet.

Four times a day on the CBEX platform, administrators dropped a code, which they call a “signal”. Investors were required to copy and paste the code into a section of their portal within the hour. CBEX said AI would then use that to make a trade, basically to buy and sell or change positions in such a way that it made a profit from price fluctuations on the investors’ behalf. Each time Fadahunsi pasted in the code, he would get 4.7 to 5 USDT as a profit, all of which accumulated towards his returns.

“So the more you do it, the more the percentage increases. In a month, I got double of 500 USDT,” he said, adding that there were also bonuses for things like referrals.

In March, users said CBEX made an adjustment where they no longer input the signal. Instead, investors just had to turn on an “AI hosting” option at the start of the day. But some investors say this was likely just a ploy to keep them going, to convince them they were still making a profit before everything crashed in April.

While some investors withdrew their returns, by the time CBEX crashed, Fadahunsi had not withdrawn any money. He had wanted to maximise the investment opportunity, to leave the funds to grow for five to six months before using them to buy a plot of land to build his future home. Now, that dream is dead.

“It is very hard, but thank God that my landlord is actually understanding,” he said.

“I am not proud of opening my mouth [to say] that I actually invested in a Ponzi scheme,” he lamented. “If I wasn’t greedy, I should have been able to withdraw two to three times on the platform, and it would have been successful.”

The USDT that CBEX invested in is a stablecoin pegged to the US dollar [File: Afolabi Sotunde/Reuters]

A history of Ponzi schemes

Even before CBEX, Ponzi schemes were not new in Nigeria.

In March, Nigeria’s anticorruption agency published a list of 58 Ponzi schemes presently operating in the country, and advised the public to “be vigilant and proactive”. This highlights the widespread presence of fraudulent entities masquerading as legitimate businesses in the country: in 23 years, Nigerians lost 911 billion naira ($589m) to Ponzi-related scams, the National Deposit Insurance Corporation (NDIC), which protects the country’s banking system, said in 2022.

Often, Ponzi schemes are able to operate by leveraging grey areas, such as obtaining an irrelevant certification that exaggerates their significance or legitimacy.

CBEX, for instance, obtained the EFCC’s anti-money laundering certificate through the corporate identity of ST Technologies International Ltd, and paraded it as a kind of clearance for conducting business.

However, the NFIU said CBEX was never granted a registration by the Securities and Exchange Commission (SEC) to operate as a Digital Assets Exchange, solicit investments from the public or perform any other function within the Nigerian capital market.

Legitimate businesses can be verified by checking the SEC website. However, experts say the vast majority of those who invest in shady schemes seem unaware or uneducated about this – 38 percent of Nigerians are financially illiterate, according to a 2023 central bank report.

At the same time, other victims may be willing participants, at least at first.

Joachim MacEbong, a senior analyst at Stears, a Lagos-based financial advisory firm, said while some victims are unwitting, others intentionally walk into Ponzi schemes hoping to make a quick profit before it crashes.

“There are those who know it is a scam, but they always feel they could cash out before everybody else. And so they would make that calculation, and it is largely because of the situation in the country; there is a lot of hardship. This kind of hardship increases the people’s desire to take risks and gamble with their very important funds,” he explained.

Nigeria’s economy has been on a downward spiral for decades, and is worse now that the country is going through its toughest economic downturn in about 30 years. Food prices have soared, and basic amenities are becoming inaccessible as the inflation rate sits at 23.71 percent. Against this backdrop, some see Ponzi schemes as a fast way to break out of the vicious cycle of poverty.

Like the proverbial early bird, early investors benefitted from the CBEX scheme, multiplying their returns for several months. Although social media is agog with complaints and bitter disappointment, some people said they had been able to make major purchases such as land and cars from their investment.

“The time scale at which you enter the investment will determine whether it will be a good investment or you will be a victim,” said Effiong of SBM Intelligence, but he added that many new investors are unaware of this catch.

‘We had a lot of plans’

Waris Oyedele is one of the people who invested their savings in CBEX because of worsening financial hardship in the country.

When he realised that the investment had crashed, he wept.

The 25-year-old comes from a low-income family. He graduated from Obafemi Awolowo University last year, but when he could not get a job, he started working as a shoemaker.

In January, he invested his savings of 800,000 naira (500 USDT); by March he had made 1,200 USDT.

He gave the returns to his younger brother to reinvest to help him pay for his future university studies, and in doing so, help ease their father’s financial burden.

“I felt bad [when we lost the money] because we had a lot of plans on it,” Oyedele said.

“I had a plan of buying a computer and going into UI/UX. Now it has gone.”

He is deeply affected by the situation and has reduced the way he spends his tiny income as he tries to rebuild his savings for future use and to support his brother.

Ponzi schemes play on psychology and human instincts by making it seem as though easy money is within reach, Effiong of SBM said.

All investments involve some form of greed, Effiong explained, and the promise of ending up with a higher return is one of the most elementary forms of human motivation: we all want more and as quickly as possible.

“What [a Ponzi scheme] does is that it also unlocks the deep-seated psychological bend for human beings to join groups – the obvious fear of missing out,” he said. “It also thrives on really aggressive marketing – all of that is to prey on the psychology of potential investors to not slow down.”

Agile tactics

Over the years, Ponzi schemes have employed several techniques to appeal to people, even going the extra mile to try and build public trust and goodwill. CBEX, for example, organised a sports competition and ran scholarships for schoolchildren to throw off suspicion, experts said.

In Nigeria, schemes rely heavily on existing investors who are incentivised to introduce new investors. They also engage in aggressive marketing using local and social media, sometimes involving radio, influencers and celebrity endorsements. Afrobeats stars Davido and Rema are some of the most popular celebrities to have unknowingly endorsed and made promo videos for Ponzi schemes in the past.

Ponzi schemes are also becoming increasingly sophisticated and dynamic as they leverage the latest technologies and digital tools, experts say.

“Many of them have apps with wonderful user experiences, which lend an air of credibility to their enterprise. Many of these scammers go to great lengths to design their products in such a way that they look and appear credible,” Effiong said.

MacEbong from Stears agreed, saying fake news and misinformation campaigns will become supercharged using AI tools, making it easier to hoodwink unsuspecting victims.

“There are numerous examples of generative AI being used to fool people who are even well informed and more savvy. When you turn these various tools against people with much lower exposure and information, they are practically defenceless,” MacEbong explained.

Regulators such as the SEC must become more proactive and come up with agile tactics to rein in Ponzi schemes and protect the public from illegitimate enterprises and shut them down before they cause harm, experts told Al Jazeera.

Businesses must be registered and thoroughly vetted because Ponzi schemes have been erroneously certified in the past, Effiong emphasised.

“There has to be a lot of financial education. Financial literacy is critical, which goes beyond how to make money, but [also] to educate the public on the tell-tale signs of Ponzi schemes. The responsibility also lies with the general public to educate themselves. If it sounds too good to be true, chances are it is too good to be true,” he said.

On May 26, EFCC said it had recovered a portion of the money stolen by CBEX and arrested two individuals promoting it. Al Jazeera tried to contact CBEX for comment through its website and publicly available phone numbers, but all were unavailable or out of service.

Meanwhile, many investors like Fadahunsi have lost hope and believe that the money they invested is all gone.

“Whatsoever the authorities retrieve, I am sure that nothing is going to come to me; I moved on already,” he said. “That is a very tough lesson for me. [Now,] I would rather keep my money in my account and spend it till the last dime.”

Aljazeera.com

Business

Black Market Naira To Dollar Exchange Rate Today 12th January 2026

What is the Dollar to Naira Exchange rate at the black market, also known as the parallel market (Aboki fx)?

You can swap your dollar for Naira at these rates.

How much is a dollar to naira today in the black market?

The exchange rate for a dollar to naira at Lagos Parallel Market (Black Market) players buy a dollar for N1490 and sell at N1505 on Sunday, 11th January 2026 according to sources at Bureau De Change (BDC).

Black Market Exchange Rate Today 12th January, 2026

Buying Rate N1485

Selling Rate N1500

The exchange rate between the US dollar (USD) and the Nigerian naira (NGN) which rate we have given above; is a topic of high constant interest for people who are Nigerian and businesses and policymakers in Nigeria.

This rate of dollars to naira exchange rate influences not only the cost of imported goods but also the cost of travel, international education, and even local prices of certain commodities.

Please note that the Central Bank of Nigeria (CBN) does not recognize the parallel market (black market), as it has directed individuals who want to engage in Forex to approach their respective banks.

Business

BREAKING: Petrol Depot Owners Crash Prices To Cheapest; Details Emerge

Petrol prices at Nigerian depots have dropped to their lowest levels in months as intense competition grips the downstream market, following the apparent collapse of the fuel supply agreement between the Dangote Petroleum Refinery and independent marketers.

Fresh findings show that depot owners have slashed ex-depot prices to as low as N710 per litre, a sharp reversal from the steep hikes recorded just weeks earlier.,

In the first week of January 2026, depot owners sharply increased gantry prices after reports emerged that the Dangote Refinery had shut down its petrol production unit for maintenance.

Although the refinery denied the reports, the speculation was enough to jolt the market.

Depot prices surged, and the increases quickly filtered through to filling stations nationwide.

Independent marketers raised gantry prices from around N720 per litre to over N800 per litre, with analysts noting that depot operators were exploiting uncertainty surrounding Africa’s largest refinery.

Depot owners reverse course as competition intensifies

The price spike, however, has proven short-lived.

Checks reveal that depot owners have now reversed course, cutting prices aggressively to stay competitive with Dangote Refinery’s pricing structure, especially as fresh fuel imports enter the Nigerian market.

Data from PetroleumPriceNG shows that several major depots reduced prices significantly in recent days.

As of Sunday, January 11, 2026, ShellPlux sold petrol at N710 per litre, MAO at N715, while A.Y.M.

Falling crude oil prices add more pressure

Energy experts say global oil market dynamics are also contributing to the decline in local petrol prices.

“Crude oil is currently trading between $50 and $60 per barrel in the international market,” energy policy analyst Adeola Yusuf told Legit.ng.

According to him, ongoing geopolitical tensions involving Venezuela and Iran have pushed crude prices lower, with direct implications for refined fuel costs.

“Crude oil is often used as a political tool and is highly sensitive to geopolitical developments. When prices drop, refined product prices usually follow, especially in domestic markets,” Yusuf explained.

Business

Good News: Cooking Gas Prices Drop As LPG Supply Improves Across Nigeria

Prices of liquefied petroleum gas (LPG), commonly known as cooking gas, are crashing in several parts of the country as retailers report improved supplies.

According to a market survey by PUNCH, retailers and consumers confirmed that prices have dropped and the product has become more available across the country.

This development follows months of scarcity, which led to a nationwide hike in prices. The scarcity peaked in September 2025.

Consumers in Lagos, Ogun, Oyo and other states confirmed that they purchased cooking gas within the N1,050 to N1,400 range. Some major marketers were also reported to be selling directly to consumers at around N900 per kilogramme.

For many households, the current prices represent a significant improvement from the sharp increases recorded last year, when LPG prices surged after a dispute involving the Dangote refinery and the Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN) led to the shutdown of some gas facilities.

Despite the improvement, several consumers said they were hopeful that prices would fall below N1,000 per kilogramme in the new year, arguing that lower costs are critical to promoting clean cooking and reducing reliance on firewood and kerosene.

Speaking on the situation, the National Chairman of the Liquefied Petroleum Gas Retailers branch of the Nigeria Union of Petroleum and Natural Gas Workers (NUPENG), Ayobami Olarinoye, said the LPG market had become relatively stable, with increased supply reaching Lagos.

According to Olarinoye, some off-takers are now receiving gas in Apapa, Lagos, helping to ease availability challenges experienced in previous months.

He explained that retail prices at street-level outlets currently range between N1,300 and N1,400 per kilogramme, noting that costs vary based on neighbourhoods, transportation and logistics.

Olarinoye added that prices could be lower at filling stations and gas plants, where operational and distribution costs are reduced.

He further disclosed that retailers currently purchase LPG from major marketers at prices between N960 and N1,050 per kilogram, depending on the supplier. According to the NUPENG official, sellers offering LPG below N1,000 per kilogramme are typically major dealers who own their own plants and sell directly to end users and do not distribute to retailers.

-

Business16 hours ago

Business16 hours agoBREAKING: Petrol Depot Owners Crash Prices To Cheapest; Details Emerge

-

News2 days ago

News2 days agoBuhari’s Ex-Minister Pantami Breaks Silence Over Alleged Wedding Plan With Aisha Buhari

-

News1 day ago

News1 day ago“Do Not Test Trump’s Resolve”: US Issues Fresh Threat To Nigeria

-

Lifestyle2 days ago

Lifestyle2 days agoChimamanda: Heartbreaking Details About What Killed Author’s Late Son Emerge

-

Entertainment22 hours ago

Entertainment22 hours agoSO SAD: Actress and Content Creator Sunshine D!es After Surgery; Details of Last Moment Trends

-

Politics4 hours ago

Politics4 hours agoFCT Minister Wike Reacts To Call For Tinubu To Sack Him

-

Sports2 days ago

Sports2 days agoAFCON: Nigerian Billionaire Splashes Dollars On Super Eagles

-

News16 hours ago

News16 hours agoBREAKING: KWAM 1 Writes Ogun Govt, Accuses Fusengbuwa Ruling House of Plot to Exclude Him From Awujale Selection